Australia’s most trusted auction house since 1985.

Industry-leading experts | Global bidding database | Client-first focus

Join Our Mailing ListCUSTOMISED | QUALIFIED | COMPREHENSIVE

Partner with Roxbury's Auction House and work with Australia's market leader in auctions.

Since 1985, we have facilitated the exchange of auction-worthy antiques, collectables, coins, banknotes, jewellery, gemstones, militaria and more.

Providing an extensive global reach, our customisation of services is unparalleled in the industry. Whether you are an individual, dealer, or investor, our team of expert appraisers, auctioneers, gemologists, and numismatists make it their business to help you in yours.

We are passionate about helping you realise your full auction potential, from finding that elusive missing piece for your collection, to supporting serious collectors, trusts, and organisations to acquire big-ticket items or liquidate entire estates.

Start your auction journey with us today.

Don't just take our word for it...

OUR UNIQUE OFFERING

INDUSTRY

Unparalleled regulatory framework which supports the highest of industry standards through the use of trust accounts and an internal auditor.

EXPERTISE

Our team of qualified experts offer centuries of combined experience and superior research skills with access to extensive historical auction data.

REACH

An unmatched global database of bidders teamed with dedicated marketers to boost each auction to its fullest potential.

INNOVATION

Innovation and technology is our specialty, providing access to quality resources, databases and historical auction results.

DISTRIBUTION

Our network of logistics and distribution channels prioritise the safety and protection of your valuables.

CONSIGN

CONSIGN

With countless annual consignments, our post-auction results are a testament to our unprecedented service. Our industry experts guide you through your custom-made consignment journey. From evaluation to marketing and selling strategies and finally, the settlement.

Start Now

SELL

SELL

Our team of trusted experts provide the highest industry pricing, considering market trends and competitor prices. Whether you prefer traditional interactions or more innovative sale methods, we are with you every step of the way.

Start Now

BUY

BUY

Buy with confidence, knowing you have access to an infinite range of items from around the world. Our diverse range of auction categories and unique collectables is ideal for treasure hunters and passionate collectors.

Start Now

APPRAISE

APPRAISE

Our services are designed to suit your collection or an estate, with a team of appraisers and independent valuers devoted to ensuring the accuracy of your free appraisal.

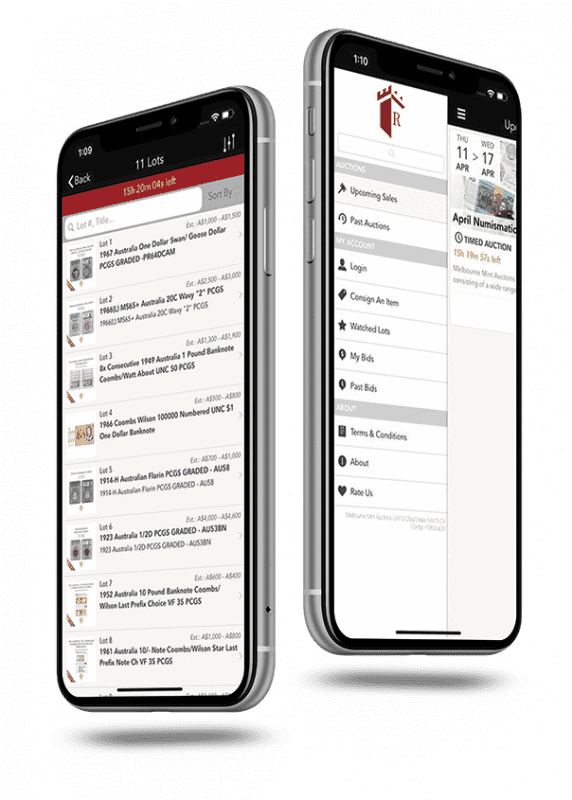

Start NowDownload Our App

Getting in on the action has never been easier with our free Roxbury’s Auction House app.

• Watch live auctions

• Track your favourite lots

• Get notified when you’re outbid

• Browse past catalogues

Simply register your details and discover the entire Roxbury’s catalogue from the palm of your hand.